In contrast to classical block codes that often specify an error-detecting or error-correcting ability, many modern block codes such as LDPC codes lack such guarantees. Instead, modern codes are evaluated in terms of their bit error rates. The most obvious way of helping students to say the right thing without correcting them when they say the wrong thing is simply to give them correct language that they could use. This is a particularly good replacement for correction of their errors when you have students who are very self-conscious when they see or hear their own errors. This can be arranged simply by trying to elicit good language onto the board rather than writing up wrong language, e.g. “What tense did we study that we often use with yet? Alternatively, you can try to predict what problems they are likely to have and give them or elicit better language first.

New technique improves accuracy of near-infrared fluorescence … – Cardiovascular Business

New technique improves accuracy of near-infrared fluorescence ….

Posted: Mon, 17 Apr 2023 20:58:16 GMT [source]

B, which depicts the LRPs obtained in the correction-forbidden and correction-encouraged conditions. LRPs to the error trials are virtually identical in both conditions up to 20 msec before the response, rendering it unlikely that the correct response is prepared in parallel with the error. A second argument against this alternative account is based on the control experiment. Here, the LRPs in bimanual and unimanual conditions diverged earlier from each other than the correct and error-LRPs in the correction-encouraged condition of the main experiment (Fig. (Fig.4 4A). However, plans to file a registration statement that incorporates previously filed financial statements before the prior periods are revised may impact this approach. S-K Item whether to report a change in internal control over financial reporting identified.

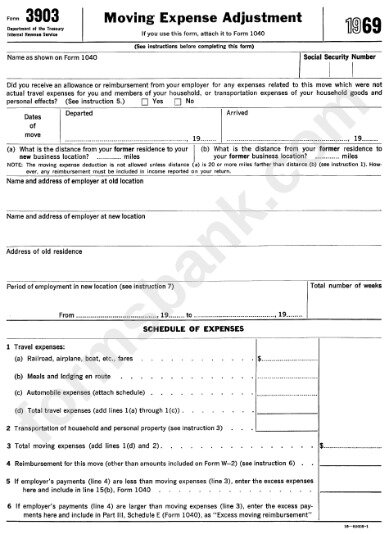

Once an error is identified, the accounting and reporting conclusions will depend on the materiality of the error to the financial statements. For a private company, the correction of a material misstatement is ordinarily accomplished by the company issuing corrected financial statements that indicate that they have been restated and include its auditor’s reissued audit report. Alternatively, it is permissible to reflect the restatement in the soon-to-be issued comparative financial statements. When the restatement is to be reflected in the soon-to-be issued comparative financial statements, the financial statements and auditor’s report would indicate that the prior periods have been restated. Users of the previously issued financial statements also must be notified that they should no longer rely on those financial statements.

The total number of 1 at these bit positions corresponding to r2 is odd, therefore, the value of the r2 bit is 1. We observe from the above figure that the bit positions that includes 1 in the first position are 1, 3, 5, 7. The total number of 1 at these bit positions corresponding to r1 is even, therefore, the value of the r1 bit is 0. Locally testable codes are error-correcting codes for which it can be checked probabilistically whether a signal is close to a codeword by only looking at a small number of positions of the signal.

Also such codes have become an important tool in computational complexity theory, e.g., for the design of probabilistically checkable proofs. There are many types of block codes; Reed–Solomon coding is noteworthy for its widespread use in compact discs, DVDs, and hard disk drives. Other examples of classical block codes include Golay, BCH, Multidimensional parity, and Hamming codes.

After between three and six stages the stories are told back to the original storytellers, who then correct any information that is wrong. The reformulation of the language will happen both by some of the students improving on the story as they tell it and in the final correction of the story stage. You can also add more of this by asking students to repeat the story back to the person they hear it from to check they have understood before they move on to tell the next person. The teacher can also get involved as a participant, or you could correct everyone in the final stage. There is also a similar teacher-led activity called Dictogloss/ Grammar Dictation, in which the teacher reads out a story a few times and students work together to construct a version of what they just heard.

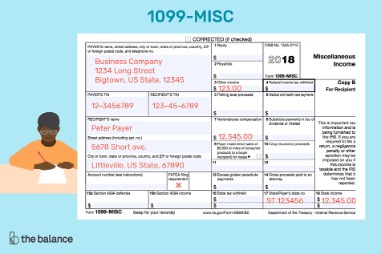

Introduction to Business

Others will allow the student to keep speaking and write the error up on the board to analyse later. Root Cause Analysis means a method of problem solving designed to identify the underlying causes of a problem. The focus of a root cause analysis is on systems, processes, and outcomes that require change to reduce the risk of harm. Correction of Errors 24.1 Activities and items described in the Technical Proposal but not priced in the Financial Proposal, shall be assumed to be included in the prices of other activities or items, and no corrections are made to the Financial Proposal. Prepare a comprehensive income statement for 2017 using the two statement format.

However, regardless of the cause, errors need to be corrected once they are discovered. Less evidence is available about the neural implementation of error corrections targeted in the current study. Bearing in mind that error correction is one of the fastest cognitive processes (Rabbitt, 1966a,b;Cooke and Diggles, 1984), it was predicted that the corrective motor command would be triggered as soon as the evaluative system has accumulated enough evidence. Critically, the onset of the corrective movement will be indexed with the onset of the lateralized readiness potential (Gratton et al., 1988; Smid et al., 1992). Thus, the relative timing of the LRP and ERN components in the present experiment could be used to infer the time course of error correction and detection. Two control experiments demonstrated the sensitivity of the LRP and ERN to error correction.

How Do You Correct Accounting Errors?

[In this section, employ the “Five Whys” method to drill down to the root cause of the issue. Five whys is an iterative technique used to explore the cause-and-effect relationships underlying a particular problem. Each answer to the question “why did this occur” then becomes the starting point for the next why. The “five” is because, typically, if you repeat the why process five times you will bottom out and reach the root cause. If there are multiple root causes, then multiple strings of whys beginning with different first answers need to be explored which requires multiple iterations.

- Once finished scanning, reread the paragraph from the beginning.

- Therefore, the entity is obligated to notify users of the financial statements that those financial statements and the related auditor’s report can no longer be relied upon.

- Is debited to purchases account then this will be an error of principle.

As such, the accountant must be prudent and exhibit good judgment when examining the causes of errors to ensure the final disclosures fairly present the economic reality of the situation. Given the complex nature of some accounting transactions, it is inevitable that errors in reported amounts will sometimes occur. IAS 8 defines errors as both omissions and misstatements, and suggests that errors result from the failure to use or misuse of reliable information that was available and could have reasonably been expected to be obtained when the financial statements were issued. Thus, management cannot claim that a misstatement is simply a change in estimate if they did not take reasonable steps to verify the original amount recorded. IAS 8 also suggests that errors can include mathematical mistakes, mistakes in application of accounting policies, oversights, misinterpretations of facts, and fraud. We can see that there is quite a range of potential causes of financial misstatements.

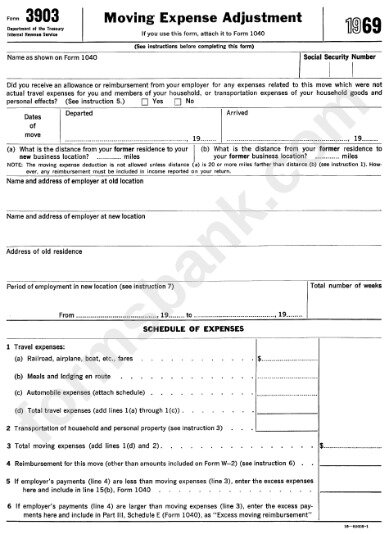

[Insert Topic Here] Correction of Errors

Subjects were encouraged to correct their erroneous responses as fast as possible, before the appearance of the next stimulus. All of the analyses reported in this study are based on this error-correction data, except for the comparisons with the control experiment and the error-correction forbidden condition from the first session. In financial statements which reflect both error corrections and reclassifications, clear and transparent disclosure about the nature of each should be included. Adjust the financial statements for each prior period presented, to reflect the error correction.

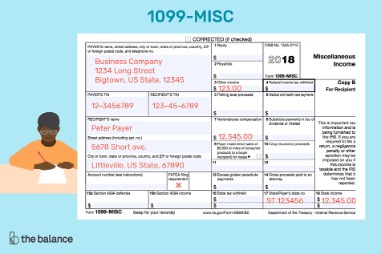

Usually the transaction, which could be an expense or sale of a service, is overlooked or forgotten. Usually, this mistake isn’t found until you do your bank reconciliation. Accounting errors are discrepancies in a company’s financial documents. For example, the mistake in the previous example was made in 2017.

Entry Reversal

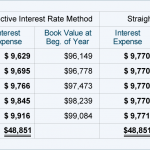

The LRPs are presented for correct and error trials for both correction-encouraged and correction-forbidden conditions. Whereas the onset of the LRP depended on the perceptual quality of the stimulus for the correct trials, the onset of the error-LRPs was independent of stimulus quality. On the other hand, the latency of the corrective response, indicated by the downswing in the error-LRP, varied as a function of the quality of the eliciting response. The corrective responses were divided according to the median of the reaction time of the correction in every subject. Thus, ERPs for fast-corrective trials and slow-corrective trials were obtained (Fig. (Fig.5). While the concepts of correcting errors are not difficult, the solutions to examples given in the textbook have combined 2 entries into a single entry.

ECC is accomplished by adding redundancy to the transmitted information using an algorithm. A redundant bit may be a complicated function of many original information bits. The original information may or may not appear literally in the encoded output; codes that include the unmodified input in the output are systematic, while those that do not are non-systematic. Minor errors are corrected in place.This means that the article is edited, and the original version containing the error is replaced. All changes are disclosed in a note attached to the article, and the changes are specifically identified. What is not an error.In the context of ongoing scholarship , articles regularly become “wrong” when new discoveries happen.

This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Retention of articles after correction, through a system of versioning, is hinted at here but not discussed in detail. Gehring WJ, Gross B, Coles MGH, Meyer DE, Donchin E. A neural system for error detection and compensation. Gehring WJ, Fencsik DE. Functions of the medial frontal cortex in the processing of conflict and errors. Dehaene S, Posner MI, Tucker DM. Localization of a neural system for error detection and compensation.

Intermediate Financial Accounting 2

Conversely, a mark to market made to the same allowance to incorporate updated economic data (e.g., unemployment figures) and the impact it could have on the customer population would represent a change in estimate. The maximum proportion of errors or missing bits that can be corrected is determined by the design of the ECC, so different forward error correcting codes are suitable for different conditions. In general, a stronger code induces more redundancy that needs to be transmitted using the available bandwidth, which reduces the effective bit-rate while improving the received effective signal-to-noise ratio. The noisy-channel coding theorem of Claude Shannon can be used to compute the maximum achievable communication bandwidth for a given maximum acceptable error probability.

62000 sq mts changed to settlement zone in Morjim – The Goan Everyday

62000 sq mts changed to settlement zone in Morjim.

Posted: Thu, 20 Apr 2023 20:32:17 GMT [source]

One is that students’ progress is measured by tests in which they are asked to choose the correct form, rather than by examining their written production. Any experienced teacher knows that you can drill students, practice a grammatical structure over and over, and they will be able to pick out the correct form on a test. But they will continue using the incorrect form in their spontaneous production. Another weakness of the studies that seem to support error correction is that any measurable improvement diminishes in time, a sure sign that recognition of the error was learned but not acquired.

Concatenated ECC codes for improved performance

It is crucial to understand the difference between a perfect sentence and a good one. After making a list of the errors, try to correct them one by one. Use the code system to give a brief definition of errors and their causes.

In this scenario, the revision to reflect revenue on a net basis rather than gross would be a correction of an error, and it would be inappropriate to disclose this change as a reclassification. Add error correction to one of your lists below, or create a new one. Also, two consecutive transmissions can be combined for error correction if neither is error free. If the learner cannot correct themselves, the next step is to pass the error to another student to correct. This serves two purposes – firstly, corrections from peers often sink in more than those from teachers, as peer knowledge implies that the original student should know this like their peers do.

As for fast corrections, the temporal overlap of the motor programs for error and corrective responses is greater, and a larger ERN is expected. In the error-detection model of the ERN, the ERN amplitude is driven by the mismatch between the representation of the computed correct response and the efference copy of the actual response (Coles et al., 2001). For error trials followed by slow corrections, it might be the case that not enough stimulus information is available at the time of the error for detection to occur effectively, leading to a smaller ERN and slower corrections. For fast corrections, more information might be available, hence a larger ERN and faster corrections. A third account of the ERN states that the amplitude of this component indexes the activity of a general evaluative system concerned with the motivational significance of the error rather than with the response conflict per se .

- Alternatively, the ERN conflict-detection model holds that the ERN merely reflects the degree of response conflict experienced by subjects (Cohen et al., 2000; Botvinik et al., 2001).

- In such cases of fraud or inappropriate earnings management, managers may deliberately try to hide the error or prevent correction of it.

- Identify and fix the root cause of outages, and events (typically one-time or edge case events) that negatively impact the customer experience and/or business/financial results.

- Gehring WJ, Gross B, Coles MGH, Meyer DE, Donchin E. A neural system for error detection and compensation.

A statement of comprehensive income using the two statement format. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory. A change in classification to correct an error should be evaluated using the framework discussed in FSP 30.7 and should be clearly disclosed as an error. A materiality analysis must consider all relevant qualitative and quantitative factors (including company and industry-specific factors). Qualitative factors may cause misstatements of quantitatively small amounts to be material.